Vail Company recorded the following transactions during November, providing a comprehensive overview of the company’s financial activities. This analysis delves into the revenue recognition, expense analysis, asset management, and liability management aspects of these transactions, assessing their impact on Vail Company’s financial performance and health.

The transactions recorded in November offer valuable insights into Vail Company’s financial operations, enabling stakeholders to make informed decisions and identify areas for improvement.

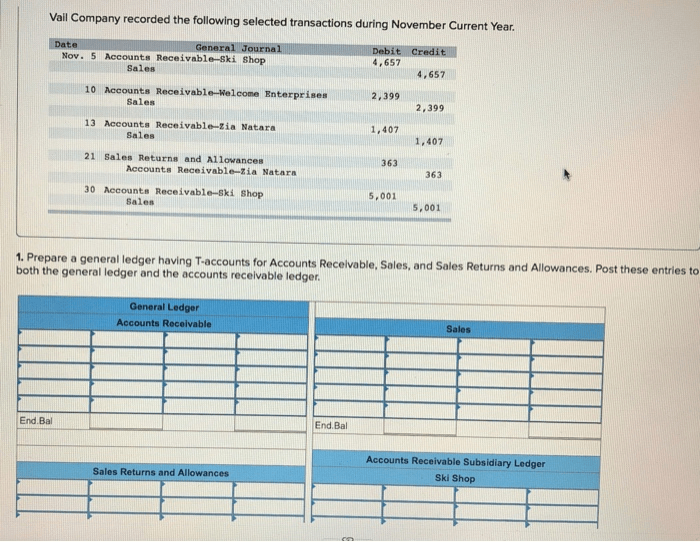

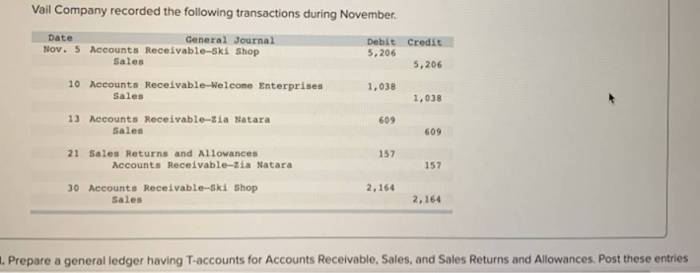

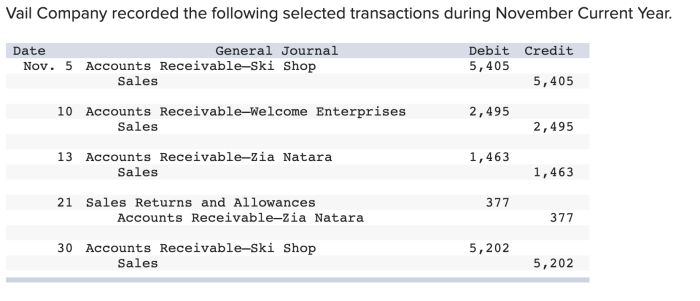

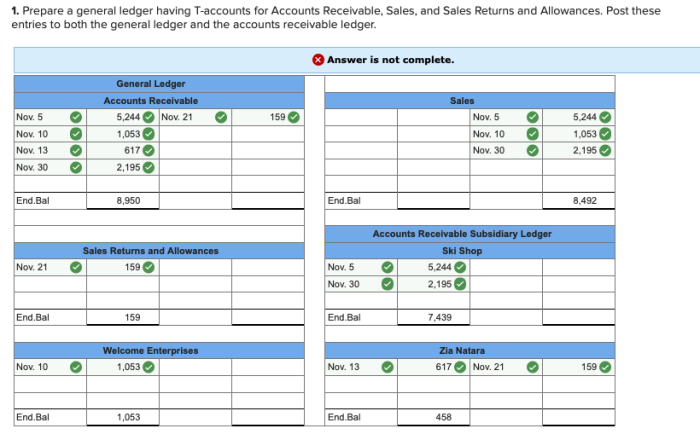

Transactions Overview

Vail Company recorded a series of transactions during November, encompassing various aspects of its financial operations. These transactions can be categorized into revenue, expenses, assets, and liabilities, providing a comprehensive overview of the company’s financial activities during the month.

Query Resolution: Vail Company Recorded The Following Transactions During November

What is the significance of Vail Company’s November transactions?

Vail Company’s November transactions provide a detailed overview of the company’s financial activities during that month, allowing stakeholders to assess its financial performance and make informed decisions.

How does Vail Company recognize revenue?

Vail Company recognizes revenue when the following criteria are met: goods or services have been delivered to customers, the amount of revenue can be reasonably estimated, it is probable that the economic benefits associated with the transaction will flow to the company, and the costs incurred in generating the revenue can be reasonably estimated.

What types of expenses did Vail Company incur in November?

Vail Company incurred various expenses in November, including salaries and wages, rent, utilities, marketing, and depreciation.